[ad_1]

The Pima County’s residential real estate market is booming as an influx of overseas buyers sparked bid wars for ownership of a plot of southern Arizona during the pandemic.

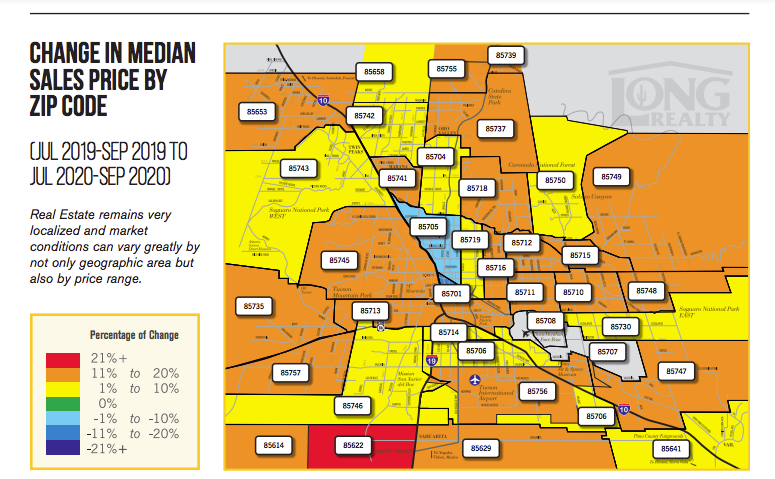

In the past six months, the average home price in southern Arizona rose nearly $ 30,000, up 14.8 percent from last year’s average sales for the county. Kevin Kaplan, vice president of Marketing and Technology at Long Realty, said the rise in home prices was due to a limited number of residential properties in the market as buyers move from larger cities to smaller communities.

“The pandemic has created a very dramatic situation where there is very little inventory compared to the number of buyers out there,” Kaplan said. “It created many situations with multiple offers, competing offers, and houses sold very quickly.”

Kaplan believes changing lifestyle needs and a lack of vacation options are other factors that add to the real estate bonanza in southern Arizona. As more people work from home, they wonder if their living space meets their needs, Kaplan said.

“I think people are trying to figure out what they really need and does their home meet those needs?” Said Kaplan. “We see that people don’t go on vacation and instead take some of those dollars and buy a second home or vacation home and possibly exercise with it for a long time.”

Another contributing factor to the recent real estate boom is historically low mortgage rates across the country. Ryan Vondrak, Nova Home Loans’ chief capital market manager, said interest rates fell after the Federal Reserve bought a huge amount of mortgage-backed securities in late March. Mortgage-backed securities are home loans bundled into securities typically bought for investment opportunities, Vondrak said.

“In a normal market, investors would buy these. That can be insurance. It could be private equity companies. It could be pension funds, ”said Vondrak. “In this case, the Federal Reserve came in and threw a lot of money into the housing market to make sure mortgage rates stay low.”

The massive takeover of mortgage-backed securities by the Federal Reserve cut interest rates from around 3.5 percent at the beginning of the year to around 2.6 percent in September, according to Vondrak. This rate cut translates into huge savings for borrowers as economic uncertainty emerges.

However, Vondrak notes that first-time home buyers are being excluded from the current housing boom due to the rise in median home prices. As bidding wars between home buyers become commonplace, those with low purchasing power attempt to participate in the promotion cannot find adequate funding, Vondrak said.

“A bidding war is taking place in the market. Today we see a lot of properties two to three offers above the asking price, ”Vondrak said. “If you fund first-time home buyers and there is a bidding war, you won’t be able to find funding because our options are limited.”

Vondrak hopes mortgage rates will remain low and average house prices will continue to rise well into 2021, especially if COVID-19 continues to drive big city dwellers into small communities. However, he believes the upcoming elections could play a role should a new government apply credit restrictions after taking office.

Both Vondrak and Kaplan agree that residential real estate in smaller cities is doing better than anyone expected as coronavirus restrictions devastate other industries. But at the beginning of the pandemic, there is cause for concern across the real estate market, said Kapaln

“There was a temporary decline in activity because there were many concerns about how the coronavirus and housing arrangements would affect us,” Kaplan said. “But by the end of April, new sales activity had increased by around 50 percent.”

Kaplan warns that the rise in the average home price in southern Arizona could be skewed by a surge in luxury sales in the area. Luxury sales are defined as real estate priced at $ 800,000 or more in the county, according to Kaplan.

“We had a very robust luxury market this year. Sales have increased by over 30 percent compared to the previous year, ”said Kaplan. “Our average price can be affected if there are many more luxury sales that can drive that number up.”

All in all, Kaplan said there are some lucrative opportunities right now for homeowners who might want to sell. He suggests that those looking to get their home on the market consult a good real estate agent in order to get the best possible deal during this exceptional time.

“This is a good opportunity for people who find that their home may not meet all of their needs,” said Kaplan. “But it’s not about whether your house will be sold, but how quickly it should be sold.”

[ad_2]

/cloudfront-us-east-1.images.arcpublishing.com/gray/XGU6SM7T4ND6XMX5IQROUZBVFY.jpg)